Government Intervention In the Economy

Why is Government Intervention Necessary

Government intervention is necessary to correct market failures, promote economic stability, and ensure fair competition. Market failures can occur when markets fail to allocate resources efficiently or fail to provide certain public goods. In these cases, the government can intervene by providing public goods, imposing taxes or subsidies, and regulating market activities.

Types of Government Intervention

Price ceiling

A price ceiling is a government-imposed limit on the price that can be charged for a particular good or service. The price ceiling is typically set below the market equilibrium price, with the intention of making the good or service more affordable for consumers. When a price ceiling is in place, the price of the good or service cannot legally exceed the ceiling, regardless of supply and demand conditions. Price ceilings are often implemented in situations where policymakers are concerned about the affordability of certain essential goods or services, such as housing or healthcare. However, price ceilings can also have unintended consequences, such as creating shortages or reducing the quality of the goods or services being provided. Because of this, a subsidy is often required to demand for the item the same as supply.

Price floors

A price floor is a government-imposed minimum price that must be paid for a particular good or service. This policy aims to protect producers by ensuring they receive a fair price for their products, and to prevent market prices from falling below a certain level. When the market price is below the price floor, the government or relevant authority can step in to purchase the excess supply, thereby reducing the supply and raising the price. However, setting a price floor can also create surplus, reduce demand and potentially lead to black markets or other forms of non-compliance.

Indirect taxes

An indirect tax is a type of tax that is levied on goods and services, rather than on individuals or businesses directly. Indirect taxes are typically included in the price of goods and services, and are usually collected by the seller on behalf of the government. Examples of indirect taxes include sales tax, value-added tax (VAT), excise tax, and tariffs. These taxes are often used to generate revenue for the government, while also influencing consumer behavior and regulating markets. Indirect taxes are generally considered regressive, as they tend to have a greater impact on low-income households than on high-income households.

![]()

Ad valorem tax

Ad valorem tax is a tax that is levied on goods or property based on their value. This means that the amount of tax charged is proportional to the value of the item being taxed. For example, a car worth $10,000 would be subject to a higher ad valorem tax than a car worth $5,000.

Excise tax

Excise tax is a tax that is levied on certain goods or services, usually at the point of sale. Excise taxes are often used to discourage the consumption of goods that are deemed harmful to individuals or society, such as tobacco, alcohol, or gasoline. Excise taxes can be levied as a fixed amount per unit of goods or as a percentage of the sale price. Unlike ad valorem taxes, the amount of excise tax is not dependent on the value of the item being taxed, but rather on the specific item or service being taxed.

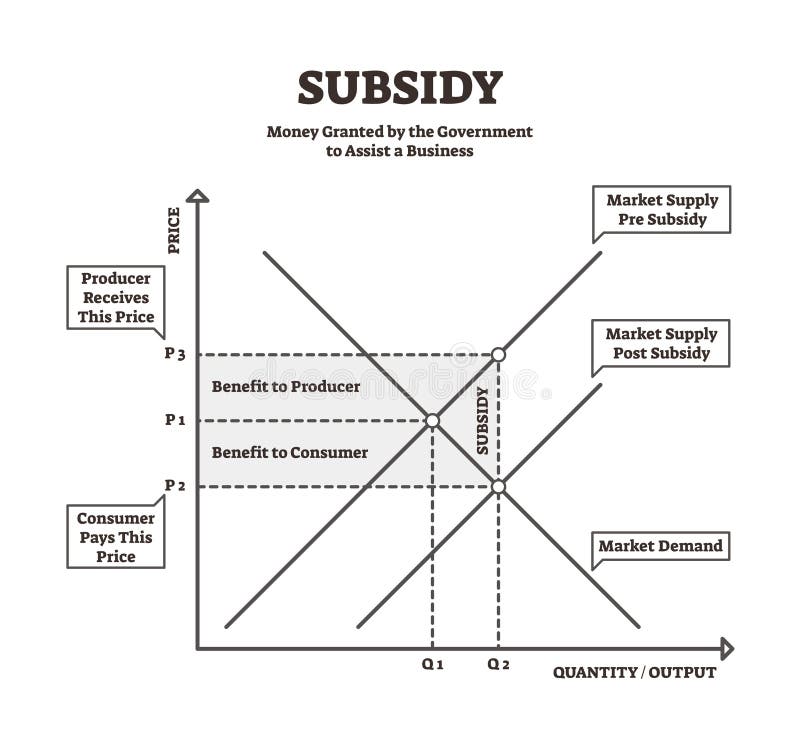

Subsidies

A subsidy is a financial assistance provided by the government to individuals or businesses to support their production or consumption activities. This form of financial aid can come in various forms, such as direct cash payments, tax breaks, loans, grants, and other incentives. Subsidies are commonly used to promote economic growth, improve social welfare, and encourage specific industries or activities. They can be targeted to specific sectors or groups and can be temporary or long-term. Ultimately, subsidies are designed to reduce the cost of goods or services, increase market demand, and make certain activities or products more accessible to consumers.

Examples of Government Intervention

Minimum Wage

The government sets a minimum wage as a price floor to ensure that workers receive a fair wage. This price floor guarantees that workers are paid at least a certain amount per hour of work, regardless of market conditions or competition.

Agricultural price supports

The government sets price floors on certain crops, such as corn and wheat, to protect farmers from fluctuations in the market. This helps to ensure that farmers receive a fair price for their crops and can maintain a stable income. This is important for national security for times when food imports aren’t available

Rent Control

Rent control is a type of price ceiling that limits the amount that landlords can charge for rental properties. For example, in New York City, there are rent control laws that limit the amount of rent that landlords can charge on certain types of rental properties.

Gasoline Price Caps

Some governments may impose price ceilings on gasoline to protect consumers from high fuel costs. In some countries, such as Venezuela, the government sets the price of gasoline below the market price to make it more affordable for consumers. This is often unwarranted as gasoline has many negative externalities.

Tobacco Tax

Many countries levy an excise tax on tobacco products to discourage smoking and generate revenue. For example, in the United States, the federal government and many states impose excise taxes on cigarettes, cigars, and other tobacco products.

Gasoline Tax

In many countries, governments impose an excise tax on gasoline to raise revenue and encourage people to use more fuel-efficient vehicles. For example, in the United States, the federal government and many states impose an excise tax on gasoline and diesel fuel.

EV Subsidy

In an effort to reduce carbon emissions and encourage the use of electric vehicles, many governments provide subsidies to buyers of electric cars. For example, in Norway, the government provides substantial subsidies and tax incentives for people who buy electric vehicles, which has helped to make Norway a global leader in electric car adoption.

Written with StackEdit.